CRM for insuranceAn insurance CRM is designed to optimize the management of the workflow from the acquisition of prospects to the closing of the sale, as well as the management and follow-up for the renewal of insurance policies. CRM for insurance makes it easier to build good relationships with policyholders and improve customer retention

How is the sale of insurance?

Finally, insurance brokers face challenges like increasing competition, disruptive new technologies, and economic challenges that make it difficult to connect with their buyers. Given this scenario, the sales strategy that they must apply is constantly evolving. New companies and technologies are revolutionizing the way consumers shop for insurance products and insurance brokers play a key role in differentiating themselves from their competition.

What do the insurance sales agent and broker do?According to the type of insurance policy, the client will hire, brokers and insurance agents carry out different types of procedures to reach a sale or renew it. For example, Agents and brokers who sell life insurance are experts at promoting plans that pay out to beneficiaries after the policyholder's death. Others sell annuities that guarantee a retirement income. For their part, health and long-term care insurance agents and sellers offer plans that cover assisted living costs and health care for seniors. In addition to short and long-term disability insurance, they may also sell dental insurance :-).

There are many activities to be carried out to manage insurance, however, among the management activities they carry out we can mention as main ones:

Many insurance advisors spend a lot of time marketing their services and building their own client base. They do this in a number of ways, such as making "cold" sales calls to people who are not current customers. They also find new customers through referrals from current customers. Faced with this situation, maintaining order and a schedule so as not to lose track is one of the keys to success, which is we present a tool that can help insurance brokers and agents make the most of their potential through the CRM for insurance. What is a CRM for insurance? |

|

|

Why are the CRMs important for insurance brokers and agents?A CRM for insurance is a valuable tool for insurance brokers, as well as insurance-producing agencies, as it allows them to timely track customer contact information and everything related to their policies such as renewals.

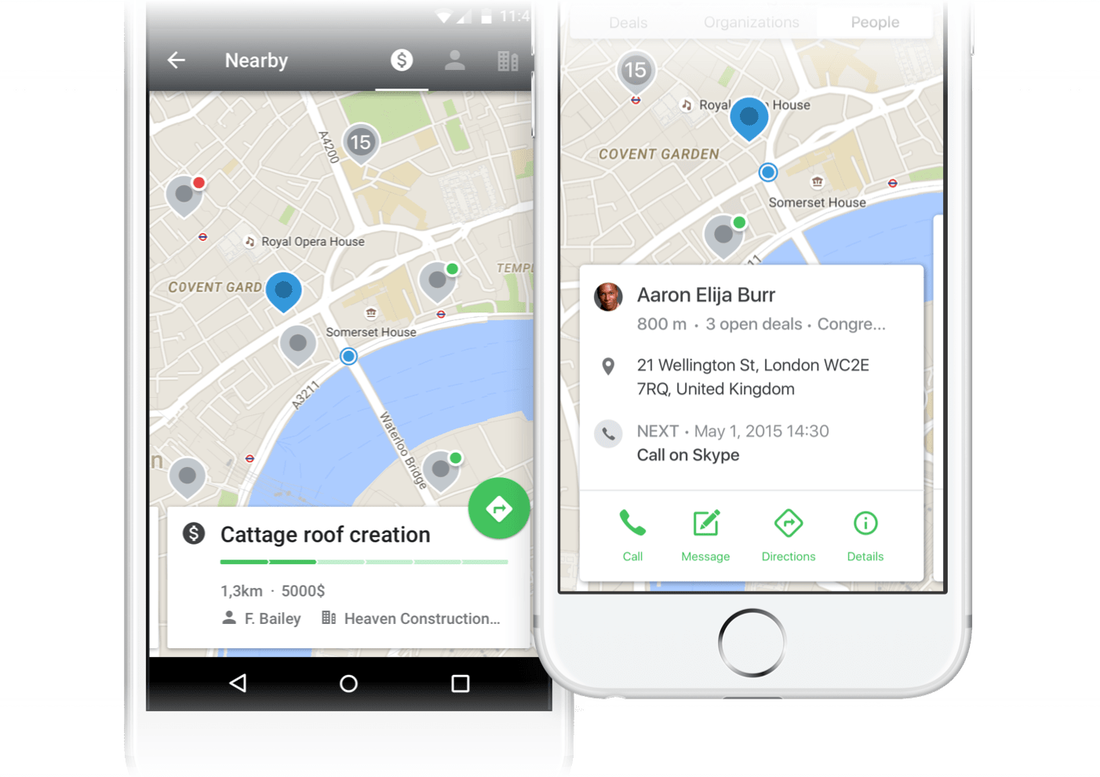

Today, insurance brokers and agents use an insurance CRM to increase sales, manage marketing campaigns to attract more policyholders and automate sales workflows. In addition, with CRM for insurance, you can create a personalized sales channel that suits your needs, and use the features to take marketing automation and lead management to the next level.

How does the CRMs work for insurance brokers and agents?Choosing the right CRM will help an insurance broker to record all the data of a potential client and qualify their needs to make a sale according to what they are requiring.

A good insurance CRM will help insurance companies and agents in:

An ideal CRM for insurance brokers and agents

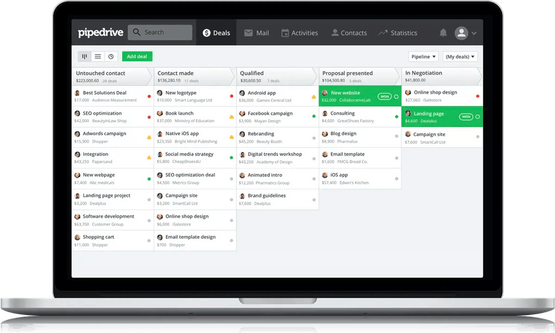

You will be able to visualize the stages of the sales process in your funnel, allowing you to see what stage your prospects are in and what action you need to take to move towards closing. Plus, your funnel gives you the information you need to plan follow-up activities, forecast your performance, and spot sales issues early on.

It uses colored indicators to let you know which leads need your attention and actions that haven't been completed on time. With this sales CRM you will always know which actions have priority. You will clearly identify each contact in the sales funnel, what stage of the process they are in, how long they have been there and what their next step is.

How to keep your customers organized with a CRM for insurance?Providing a customer experience that builds loyalty is a critical value proposition for insurance agencies today. The longer it takes to serve prospects and process their claims or needs, the more likely it is that the competition will find “fertile ground” to take your client.

The CRM for insurance brokers allows you to respond to customers in record time. All your communications are stored in one place so reps know which clients are assigned to them and when they need to respond to fulfill service contracts and exceed the insurance industry standard. Integrate CRM with other applications you currently useWith a CRM for insurance, you'll want your sales and customer support team to work alongside other third-party applications. These integrations seek to boost your business and optimize the productivity of agents and brokers.

Some integrations insurance companies use include:

* Full access! You do not need to enter your credit card details *

Why choose Pipedrive CRM for your insurance company?

How did Pipedrive help a health insurance brokerage streamline its sales process?

|

|