¿Qué son los servicios financieros?

|

How businesses and consumers obtain financial products such as loans and insurance.

There has been a call for stricter regulation of financial services in the wake of the global crisis. Although, what exactly is a financial service? There is a difference between a good (something material that lasts, either for a long or short time) and a service between the things that money can buy (a task that someone else does for you). |

There is a difference between a good (something material that lasts, either for a long or a short time) and a service between the things that money can buy (a task that someone else does for you). A financial service is something that is best described as the process of acquiring the financial asset and not the financial asset itself, such as a mortgage loan to buy a home or an auto insurance policy. It is about the transaction necessary to obtain the financial good, in other words. The financial industry includes a wide range of transactions in areas such as real estate, consumer finance, banking, and insurance. It also covers a broad spectrum of mutual funds, including equities

How do financial services work?

Among the many financial services available, these are some of the best.

Associated services and insurance

• Direct insurers combine payments (premiums) from people seeking risk coverage and pay people who experience a covered personal or business event, such as a car accident or shipwreck.

• For a fee, reinsurers, who may be wealthy individuals or legal entities, agree to cover some of the risks assumed by a direct insurer.

• Insurance intermediaries, such as brokers and agencies, connect those seeking to cover risk with those willing to assume it for a fee.

Banks and other financial service providers

• Providers pay those who give them money, which they use to make loans; accept deposits and refundable funds; then read or make investments with the intention of profiting from the difference between what depositors pay and what they receive from borrowers.

• Manage payment systems: By enabling providers of funds and credit card account settlement, such as checks and wire transfers, to transfer money from payers to recipients.

• Trading: Providers facilitate the buying and selling of derivatives, currencies and securities by companies.

• Issue securities: By selling bonds or shares in corporations, providers help borrowers raise money.

• Manage assets: On behalf of customers who pay for their experience, providers make recommendations or invest money.

Associated services and insurance

• Direct insurers combine payments (premiums) from people seeking risk coverage and pay people who experience a covered personal or business event, such as a car accident or shipwreck.

• For a fee, reinsurers, who may be wealthy individuals or legal entities, agree to cover some of the risks assumed by a direct insurer.

• Insurance intermediaries, such as brokers and agencies, connect those seeking to cover risk with those willing to assume it for a fee.

Banks and other financial service providers

• Providers pay those who give them money, which they use to make loans; accept deposits and refundable funds; then read or make investments with the intention of profiting from the difference between what depositors pay and what they receive from borrowers.

• Manage payment systems: By enabling providers of funds and credit card account settlement, such as checks and wire transfers, to transfer money from payers to recipients.

• Trading: Providers facilitate the buying and selling of derivatives, currencies and securities by companies.

• Issue securities: By selling bonds or shares in corporations, providers help borrowers raise money.

• Manage assets: On behalf of customers who pay for their experience, providers make recommendations or invest money.

CRM for Financial Services

Designed for teams looking for a simple, yet powerful sales tool.

Pipedrive CRM used in the financial sector

Tracking leads and the sales process in the financial sector has never been easier thanks to Pipedrive, a powerful, simple and agile CRM.

With the Pipedrive customer relationship management (CRM) tool, you can keep track of prospects and leads through your sales pipeline and ensure that you never miss the opportunity to convert them into customers.

Track sales opportunities and forecast sales revenue easily.

Perfectly customizable, the Pipedrive CRM can be used by organizations operating in the banking, insurance, leasing, mortgages, credit sectors and much more.

With the Pipedrive customer relationship management (CRM) tool, you can keep track of prospects and leads through your sales pipeline and ensure that you never miss the opportunity to convert them into customers.

Track sales opportunities and forecast sales revenue easily.

Perfectly customizable, the Pipedrive CRM can be used by organizations operating in the banking, insurance, leasing, mortgages, credit sectors and much more.

Try Pipedrive CRM free for 45 days

* You do not need to enter a credit card * Just use our promotional code: ca-sersoteico

How does a CRM boost sale in financial organizations?

Customer relationship management (CRM) is an essential element of success in today's dynamic and challenging market. Mastering CRM software can greatly improve your win rates and speed of sales.

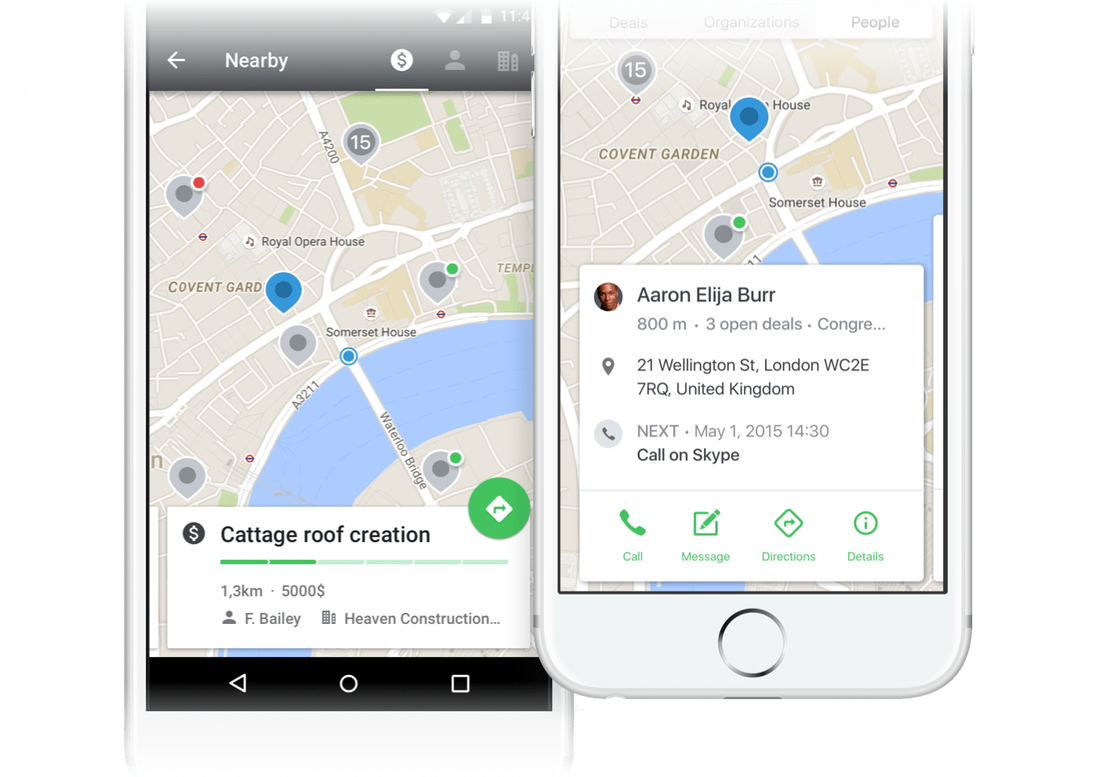

Pipedrive is an easy-to-learn and easy-to-use solution that includes a mobile app that ensures you are always in the know while you are out of the office.

Say goodbye to endless spreadsheets and get ready for custom reports, dashboards, and analytics. With multiple sales and loan placement reporting templates to measure your team's efficiency, Pipedrive offers all the tools you need to improve your performance and keep everything organized.

Pipedrive is an easy-to-learn and easy-to-use solution that includes a mobile app that ensures you are always in the know while you are out of the office.

Say goodbye to endless spreadsheets and get ready for custom reports, dashboards, and analytics. With multiple sales and loan placement reporting templates to measure your team's efficiency, Pipedrive offers all the tools you need to improve your performance and keep everything organized.

Applied in Insurance SalesInsurance companies sell a wide range of protections, including property and casualty insurance, life insurance, etc. With Pipedrive you can integrate with your own management systems.

|

Placement of mortgage loansPipedrive can be integrated with your own systems for mortgage loans, client application portals or other similar applications.

|

Placement of credits for SMEsPipedrive can be used by companies specializing in loans for small and medium-sized companies, such as savings cooperatives and credit.

|

How to implement the Pipedrive CRM in your Organization?

Finance organizations need help getting used to a new CRM, save time, and involve their sales teams. That's why we prioritize offering hands-on support throughout the CRM adoption process, ensuring that all organizations can make full use of Pipedrive's set of powerful features.

When it comes to Pipedrive CRM implementations in financial services organizations, CRM Consulting Services offers a full team of professional services, including:

When it comes to Pipedrive CRM implementations in financial services organizations, CRM Consulting Services offers a full team of professional services, including:

|

*Advice

*User support |

*Integration with existing systems.

*Training |

*Configuration and parameterization

*Proactive support |

Each segment of the financial services industry is unique. Wealth management, insurance, mortgages, and banking have their own unique products, pricing models, pipelines, reporting standards, applications, and workflows.

At Pipedrive, we understand how important it is to have a tool that you can customize to suit the way you work, rather than changing your routine to suit your CRM, and the financial services industry.

Add pipeline stages that are specific to your business. For example, if you are an insurance or banking company, add a stage to notify prospects and customers about your other relevant products.

At Pipedrive, we understand how important it is to have a tool that you can customize to suit the way you work, rather than changing your routine to suit your CRM, and the financial services industry.

Add pipeline stages that are specific to your business. For example, if you are an insurance or banking company, add a stage to notify prospects and customers about your other relevant products.

Easy to use, convenient and intuitive.

|

Pipedrive offers you all the benefits of real estate CRM without problems:

|

|

Very useful reports and reports

To meet your business goals, you need to know at all times your level of performance and what needs to be done more. So that you have all the KPIs you are looking for, we have created magnificent charts and graphs that are generated automatically, saving time, effort and presenting it so that it is easy to find and quick to understand.

Do you have any doubts or questions? We are here to help you

Try Pipedrive CRM free for 45 days

* You do not need to enter a credit card * Just use our promotional code: ca-sersoteico